does shopify provide tax documents

1099s are available to download in the payments section. When you set up Shopify Payments you need to enter your tax details.

Shopify Clean Packing Slip Template Code For Order Printer English Malimoron

You might need to register your business with your local or federal tax authority to handle your sales tax.

. Its close to an invoice but its missing a few key elements like your. This form tag allows developers to quickly. Ad Best POS System.

Update your tax details. Accept Payments Anywhere Never Lose a Sale. For origin-based tax jurisdictions such as California the destination is currently shown instead of the region to which the tax applies.

Shopify will issue a 1099 to store owners and the IRS when a store hits 200 transactions and 20K in sales. Dated invoices from supplier outlining quantities. Quick Easy to Set Up.

See Why More Businesses Trust Shopify. You may qualify to receive a 1099-K form if you meet certain sales and transactions thresholds. Does Shopify provide tax documents.

Go to the payments section. Having the necessary documents readily available when meeting your Shopify tax accountant will save a lot of time. By admin January 12 2022.

On the Tax documents dialog box click Download PDF next to the invoice that you want to download. The earlier deadline gives partners a chance to receive Schedule K-1s before the personal tax return due. In the Shopify Payments section click View payouts.

Ecommerce shops need to pay too. Tax planning takes careful consideration and attention to. Recently I got e-mail from Shopify have Shopify account since 2014 that request a picture of my ID government issued otherwise my money will be hold by Shopify.

Ad Best POS System. To start the process of registering your business online you need to go to the website of the Ministry of Corporate Affairs. While tax laws and regulations vary based on factors like location and what youre selling Shopify makes it easy for you to manage your taxes.

With that said its worth noting that Shopify does. March 15 is the deadline to file individual and partnership tax returns. Sell In-Store Online.

When a customer passes an order on your Shopify store they are automatically sent an email confirming the order. The Taxes finance report can provide a summary of the sales taxes that. Shopify will issue a 1099 to store owners and the IRS when a store hits 200 transactions and 20K in sales.

As you set up taxes you can access and review your settings on the Taxes page in your Shopify admin. Not qualifying for a 1099-K doesnt free you from paying taxes and Shopify still reports your income to the IRS so you must find the documentation for your earnings yourself. Business license business registration documents with company number or business tax filing record.

By admin January 12 2022. If you qualify for a 1099-K the form will show up and you will be able to download it. The calculations and reports.

Shopify helps to automate charging sales taxes but Shopify doesnt remit or file your taxes for you. Click on Documents at the top left corner. 1099s are available to.

Download your 1099-K form on the Legal and tax information page. With a prebuilt integration and free trial getting started may be easier than you think. Quick Easy to Set Up.

You can follow this guide to determine where in the United States you might be. Ad Automate Shopify tax rules compliance with help from Avalara. The state or province of the tax rate.

Sell In-Store Online. You need to fill out forms for the IRS if you have more than 20000 in sales with more than 200 transactions. Shopify doesnt file or remit your sales taxes for you.

See Why More Businesses Trust Shopify. Accept Payments Anywhere Never Lose a Sale. Do i need a tax id to sell on shopify.

Using this tag automates the process of assigning actions and values when building different types of forms on Shopify pages. Last year the Supreme Court.

View Paid Themes On Shopify Avada Commerce Shopify Tutorial Avada

How To Start An Online Store With Shopify The Shop Files Online Boutique Business Starting An Online Boutique Shopify Website Design

Add Product Reviews To Shopify Shopify Apps Shopify Store Shopify

Build Unique Customer Experiences Using Shopify S Api Customer Experience Commerce Marketing Shopify

Avada Commerce Offers Shopify Apps With New Features For Enhancing Online Stores Performance Market Sanctum Shopify Apps Avada Google Tag Manager

How To Create A Fixed Value Or Percentage Discount On Shopify Shopify Discounted Stuff To Buy

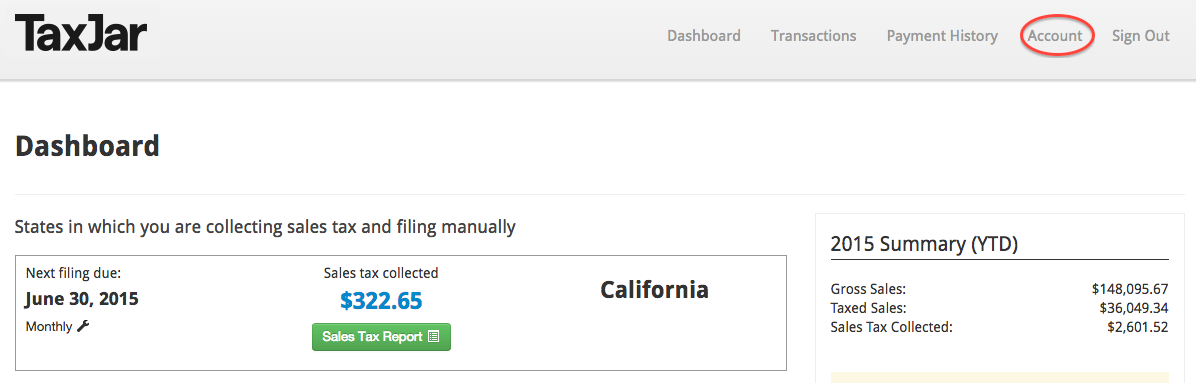

Sales Tax Guide For Shopify Sellers Taxjar Developers

Sales Tax Guide For Shopify Sellers Taxjar Developers

How To Set Up Tax Exempt Customers On Shopify Avada Commerce In 2020 Shopify How To Know Shopify Site

Spreadsheets For Shopify Sellers Are A Great Way To Track Sales And Expenses For Your Online S Shopify Business Drop Shipping Business Small Business Resources

Ecommerce Businesses Can Integrate Shopping Carts Automatically From Walmart Amazon Shopify And Ebay Sales Tax Filing Taxes Revenue

Shopify Shipping Hack Video Small Business Marketing Business Marketing Small Business Advice

Shopify Sales Tax The Ultimate Guide For Merchants Updated 2020 Avada Commerce Sales Tax Tax Software Business Tax

Organize Small Business Taxes Plus Free Printables Business Organization Printables Tax Organization Business Tax

Shopify Colorado Sales Tax Ecommerce Bookkeeping Services Business Structure

Set Tax Rate For New Pos Location On Shopify A How To Guide Shopify Sms Credit Card Payment